Buy

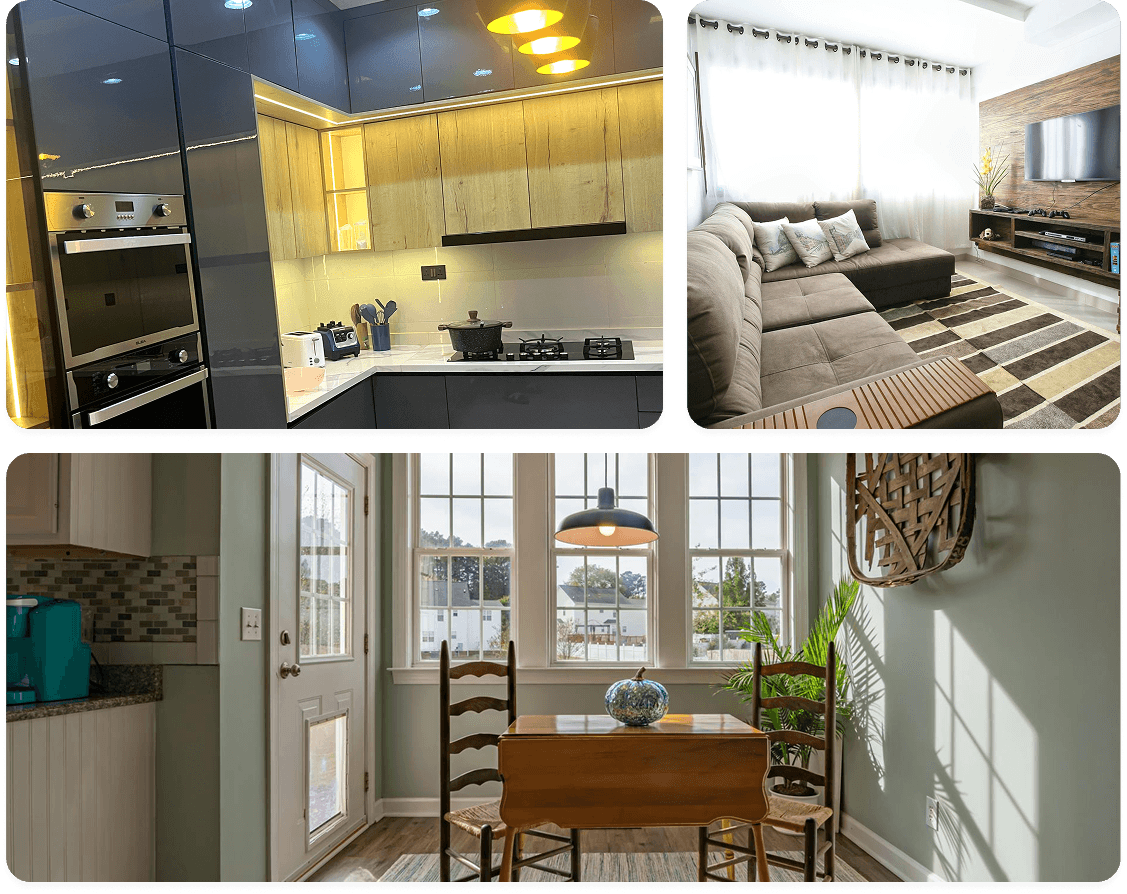

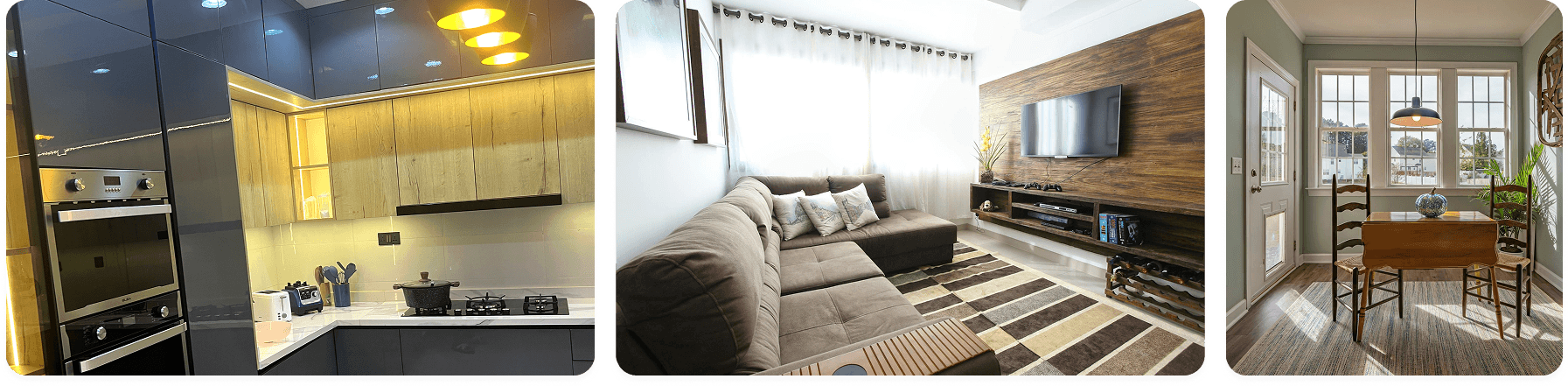

Explore and purchase your home from top developers & vetted property sellers (With land titles) on various purchase plans and long term loan options.

Find a Home to Buy

👀 PEOPLE HAVE SEEN THIS

We have taken real estate beyond mere listings. Conduct secure real estate transactions on our platform trusted by more than 4,000 customers, and 30+ companies

Explore Our Products

Get started with one of our carefully crafted products & services.

Explore and purchase your home from top developers & vetted property sellers (With land titles) on various purchase plans and long term loan options.

Find a Home to Buy

Find your next getaway spot, staycation, or business trip spot. Avoid extra charges, find detailed information, and reserve a short let.

Reserve a Short Let

Become a real estate investor without breaking the bank. Invest in real estate assets and grow your portfolio with friends and family (in a private investment group) or with the public (fractionally, like a stock exchange).

Sell your property with us, a company and partner you can trust. Our simple process makes it easy for sellers to list their properties and sell their properties on various purchase plans to the 1000’s of potential buyers who visit Giddaa monthly.

Explore and purchase homes from top developers & vetted property sellers (With land titles) on various purchase plans.

Explore Our Services

We’ve built solutions & tools for property developers, and property managers specifically operating in the Nigerian Market - Our solutions fit like a glove.

Learn More

Organizations we’ve partnered with to make real estate in Nigeria a pleasant experience for all.

Reasons why you should embark on your real estate journey with us, and our products..

Our thorough and transprarent process ensure you avoid the typical flaws and legal issues that exist when buying a home in Nigeria. We ensure you go through due diligence and have little to no risk when making one of the biggest investments in your life.

Find all the different ways you can buy a house in Nigeria. From Government mortgages to payment pans, and outright purchase, you’re covered! We ensure you use a payment option that suits your current budget and situation.

Easily use our affordability engine to view houses that are within your budget relative to your income and age. No need for long talk. You can visually see whether you can afford a house or not.

Find your dream home with over 65 houses to choose from and a dedicated account executive to ease your home search.

Your dedicated account executive is a skilled real estate and/or mortgage professional who will protect your interest at all times. If a deal is against your long-term interest, we will advice you against it.

We charge just 3% buyer commissions for buyers who buy directly through us. Buying a house will already make you think about your account. We have chosen not to add to that burden.

What our customers and partners think about us.

Executive Secretary, Residencia Moderno

" Giddaa helps customers find genuine developers; properties that are real "

Made it this far? What are you waiting for? Get started with one of our products today!.

Find homes on various purchase plans; apply to buy them with your account executive.

Explore high quality short lets, with no booking fees and excellent support.

Invest in income-generating real estate to secure and grow your wealth.

Quickly sell your home to willing buyers on different purchase plans as an owner, developer, or agent.

Access mortgage advisory, construction loan support, and free RSA guidance.

Manage your enterprise - for property developers, property managers, realtors, and mortgage banks.